The FBT year ends on 31 March 2020 and each employer is required to calculate their liability for FBT. Where a liability for FBT exists, an annual return is required to be lodged and any tax paid by 21 May 2020. However, if the return is lodged electronically by a Tax Agent the due date of lodgement is 25 June 2020 while the payment due date is 28 May 2020.

The FBT year ends on 31 March 2020 and each employer is required to calculate their liability for FBT. Where a liability for FBT exists, an annual return is required to be lodged and any tax paid by 21 May 2020. However, if the return is lodged electronically by a Tax Agent the due date of lodgement is 25 June 2020 while the payment due date is 28 May 2020.

2020 03 StewartBrown Aged Care Financial Performance December 2019 Survey Sector Report

The StewartBrown December 2019 Aged Care Financial Performance Survey incorporates detailed financial and supporting data from 1,125 aged care homes and 36,529 home care packages across Australia. The quarterly survey is the largest benchmark in the aged care sector and provides invaluable insight into the trends and drivers of financial performance at the sector level and at the aged care home or programme level.

Click here to download the December 2019 survey Sector Report which includes a summary of the analysis completed on the organisational, residential care and home care data supplied by our participants, thank you to all the participants that supplied data for this survey.

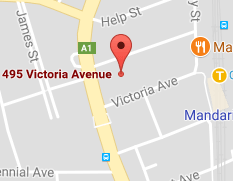

If you have any queries regarding this report or on any of our audit and assurance or consulting services, please do not hesitate to contact our office on (02) 9412 3033 or call 0429 680 785.

2020 03 Special Newsletter COVID-19 Assistance - New Developments

Welcome to our special update edition of the StewartBrown newsletter where we keep you updated with the latest tax and Government assistance packages being made available in response to the COVID-19 pandemic.

2020 03 StewartBrown Aged Care Survey - December Summary Results

The Aged Care Financial Performance Survey – December 2019 six months summary results can be downloaded here. We will be providing this style of summary results each quarter for ease of review to the wider stakeholder and general audience.

The detailed sector report will still be prepared and distributed as previously, and posted on our web as this sector report includes more specific commentary and analysis.

The sector report and participant reports will be distributed on Monday 23 March 2020.

EDIT: The sector report has now been released and can be accessed by clicking here.

2020 03 Special Newsletter COVID-19 Assistance - March 2020

Welcome to our special edition of the StewartBrown newsletter where we will keep you informed and updated with the latest tax and Government assistance package developments as they arise.