The StewartBrown Aged Care Financial Performance Survey incorporates detailed financial and supporting data from over 865 residential aged care facilities and 475 home care programs across Australia. The quarterly survey is the largest benchmark within the aged care sector and provides an invaluable insight into the trends and drivers of financial performance at the sector level and at the facility or program level.

Financial

2018 06 Aged Care Sector March 2018 Reports Released

The StewartBrown March 2018 Aged Care Financial Performance Survey (ACFPS) incorporates detailed financial and supporting data from over 911 residential aged care facilities and over 21,700 home care packages (412 home care programs) across Australia. The quarterly survey is the largest benchmark within the aged care sector and provides an invaluable insight into the trends and drivers of financial performance at the sector level and at the facility or program level.

2017 07 Aged care enters a pressing cost management phase

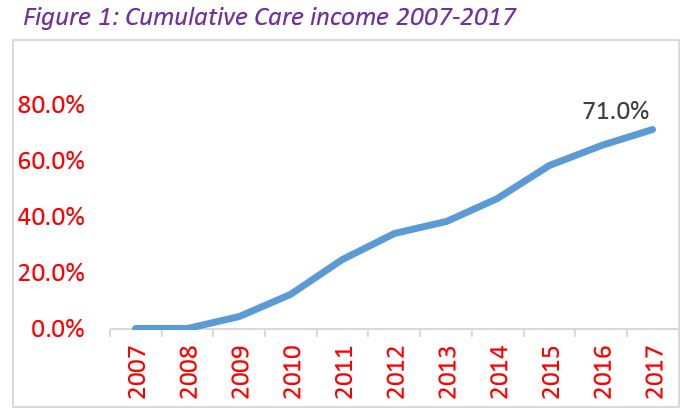

It could be said that from the initiation of the new Aged Care Funding Instrument (ACFI) in March of 2008 that the aged care sector was in a ‘revenue phase’ that saw the cumulative Care Income grow to 71% at March 2017 as shown in Figure 1.

Now there will be a number of people who may see this figure and suggest that providers have done very nicely out of this growth, but while the revenue grew, so did the costs. For example Care Wages grew more than 75% in the same time period.

During this same period the Care Result (care revenue minus care expenses) grew from $4.40 per bed day in June 2007 to a sector high of $14.92 in September of 2011.

Then the first fiscal cliff appeared as the government looked to reign in the growth of their share of care revenue, so that by June 2013 the Care Result had fallen back to $6.79 per bed day.

2017 11 Aged Care Sector 2017 June Reports Released

The StewartBrown Aged Care Financial Performance Survey incorporates detailed financial and supporting data from over 950 residential aged care facilities and 500 home care programs across Australia. The quarterly survey is the largest benchmark within the aged care sector and provides an invaluable insight into the trends and drivers of financial performance at the sector level and at the facility or program level.

2017 11 Corporate Administration Survey

We recently conducted the 2017 Corporate Administration Survey and had a response from a large number of aged care providers covering 457 residential care facilities with 35,164 operational places, 12,972 home care clients and 15,395 occupied independent living units. Across the 58 organisations that submitted data, revenues totalled $4.8 billion and aggregated total assets were a total of $15.8 billion.

2017 11 Newsletter

We hope to keep you informed of the important tax developments and issues affecting businesses in Australia today and throughout the year ahead.

2018 01 Aged Care Sector 2017 September Reports Released

The StewartBrown Aged Care Financial Performance Survey incorporates detailed financial and supporting data from over 830 residential aged care facilities and 420 home care programs across Australia. The quarterly survey is the largest benchmark within the aged care sector and provides an invaluable insight into the trends and drivers of financial performance at the sector level and at the facility or program level.

2018 03 Listed Providers Analysis Report - December 2017

The listed aged care providers Estia, Regis and Japara have recently released their results for the six months to 31 December 2017. StewartBrown has reviewed the Listed Providers Financial Reports and Investor Presentations and a summary of this analysis can be found in the Listed Providers Analysis Report (December 2017).

2018 05 Federal Budget 2018 – How will it impact you and your business?

The tax and superannuation highlights of Tuesday night’s Budget are summarised below:-

2018 06 StewartBrown Submission to Senate Inquiry into Financial and Tax Practices of For-Profit aged care Providers

On 10 May 2018 the Australian Senate referred an Inquiry titled “the financial and tax practices of for‐profit aged care providers” to the Economics References Committee, with a report due by 14 August 2018. In particular, the Inquiry is to cover:

- the use of any tax avoidance or aggressive tax minimisation strategies;

- the associated impacts on the quality of service delivery, the sustainability of the sector, or value for money for government;

- the adequacy of accountability and probity mechanisms for the expenditure of taxpayer money;

- whether current practices meet public expectations; and

- any other related matters.

2018 10 Aged Care Sector 2018 June Reports Released

The StewartBrown June 2018 Aged Care Financial Performance Survey (ACFPS) incorporates detailed financial and supporting data from over 974 residential aged care facilities and over 24,952 home care packages across Australia. The quarterly survey is the largest benchmark within the aged care sector and provides an invaluable insight into the trends and drivers of financial performance at the sector level and at the facility or program level.

2018 10 ATO Targeting Work-From-Home Expenses this Tax Time

The Tax Office has earmarked home office expenses as a key focus area this tax time, citing a lack of education contributing to a high amount of mistakes, errors, and questionable claims.

According to the ATO a record $7.9 billion in deductions for ‘other work-related expenses’ were claimed by 6.7 million taxpayers last year, with the Tax Office noticing a rise in expenses related to working from home. With increasing numbers of employees working from home, extra costs related to home office could be deductible, but the ATO advise they are seeing some taxpayers either over-claiming and/or claiming private expenses which are not tax deductible.

They cite increasing evidence that many taxpayers don’t know what they can and cannot claim. In particular, they are seeing some taxpayers claiming expenses they never paid for, expenses their employer reimbursed, private expenses and expenses with no supporting records. While acknowledging that costs incurred as a direct result of working from home can be legitimately claimed, the ATO have noticed taxpayers making claims for all sorts of private expenses.

Apparently a very common issue is people claiming the entire amount of an expense (like their internet or mobile phone), not just the extra part related to their work. An ATO spokesperson advises “If working from home means sitting in front of the TV or at the kitchen table doing some emails, it’s unlikely that you are incurring any additional expenses. However, if you have a separate work area, then you can claim the work-related portion of running expenses for that space. Employees cannot generally claim occupancy-related expenses like rent, mortgage repayments, property insurance, land taxes and rates.”

The ATO have revealed that over $53 million in errors had been corrected in the first two months of tax time in 2018, stemming from “simple mistakes” such as not declaring all income or over-claiming deductions. If you are unsure about what you might be able to claim please contact our office to discuss further.

2018 10 Security Alert: BSB & Account Number Changes

If you are ever asked to change or update a BSB and Account number as a result of an email received from a supplier or known associate, it is critical that you verbally validate this request as well.

Reports to the Australian Competition and Consumer Commission (ACCC) and Australian Cybercrime Online Reporting Network (ACORN) about scams of this sort have exposed over $22.1 million in funds being transferred from businesses to scammer accounts during 2017.

Our top tips to avoid incurring financial loss to scammers are:

- Always verbally check the BSB and Account number changes using a trusted phone number. Confirming a change via email is not a secure method of validation.

- Scammers often pose as executive staff members to direct employees to make urgent payments. Once again, always verbally validate these requests using a trusted phone number.

- If you are unable to contact the requestor, contact the recipient bank to confirm if the BSB and Account number match the name on the account.

For more information on how to protect your business speak to your StewartBrown Partner of Manager and/or contact your bank.

This threat is real and should not be taken lightly! A client of our firm recently experienced this scam and unfortunately lost out financially because of it. Be vigilant and train your staff to be on the alert.

2019 01 Aged Care Financial Performance Survey - September 2018

Click here to download a PDF version of the report below.

2019 03 StewartBrown Financial Advisory march 2019 investment update

Given the upcoming federal election and the likelihood of the Australian Labor Party (ALP) winning the election, we wanted to bring you this update on the proposed changes we believe will impact clients and how we are positioning client portfolios to get ready for this change.

2019 06 Year End Employer Obligations and Employment Update For the year ending 30 June 2019

This special edition of our newsletter is to remind you of your 2019 financial year employer obligations and provide you with an update on employment matters:-

IMPORTANT CONSIDERATIONS

1. SINGLE TOUCH PAYROLL ("STP")

STP is a Government initiative to further simplify business reporting obligations. It is a mandatory reporting requirement for employers and will require employers to report payments such as salaries and wages, pay as you go (PAYG) withholding and superannuation information to the Australian Taxation Office (“ATO”) directly from their payroll systems at the same time employees are paid. It will eventually apply to every payroll system in Australia.

2019 07 StewartBrown’s 2019 Aged Care Finance Forum

Our roadshow is taking an all-day forum around Australia, starting 15 October in Sydney then all the state capitals, and finishing in Launceston on 13 November.

Share Knowledge and Insights From Across the Whole Sector

The Aged Care Finance Forum is designed to inform the aged care sector. It explores the policy, operational and financial changes in the sector in 2019 and beyond, helping operators survive and prosper in an uncertain but exciting environment. The Forum is the opportunity for aged care providers and finance and operational staff across the sector to discuss challenges and share knowledge and insights.

2019 08 Callaghan, Lane, Somerville and Woods to speak at Forum

More speakers have joined our programme at the StewartBrown 2019 Aged Care Finance Forums: Professor Mike Woods of the University of Technology, Sydney; Rachel Lane, author and aged care consultant head of Aged Care Gurus; Mike Callaghan, Chair of the Aged Care Financing Authority; and Fiona Somerville, Director of The Ideal Consultancy, will be joining us and presenting their perspectives on the Aged Care sector. Leaving no capital city out, StewartBrown is holding a forum in each of Sydney, Melbourne, Brisbane, Adelaide, Perth, Hobart and Launceston. Speakers will vary slightly from venue to venue, so we will be updating booked attendees by email - and in this space - with complete lists of speakers in each city.

2019 09 StewartBrown Listed Providers Analysis 2019 June Report

The listed aged care providers Estia, Regis and Japara have recently released their full year results to 30 June 2019.

The listed aged care providers Estia, Regis and Japara have recently released their full year results to 30 June 2019.

2020 03 Special Newsletter COVID-19 Assistance - New Developments

Welcome to our special update edition of the StewartBrown newsletter where we keep you updated with the latest tax and Government assistance packages being made available in response to the COVID-19 pandemic.